26 Aug 12 Best Practices for Managing Multi-State Payroll Taxes

Mobile workers have become an important and growing part of the modern workforce. Cloud computing and ubiquitous high-speed internet have enabled many industries to support remote workers. Businesses offering either fully remote or hybrid work flexibility have experienced increased competition for top talent during the current labor shortage. The more employees move around, the more multi-state payroll tax complexities arise.

According to the American Payroll Association, “the default rule of state income tax withholding is to withhold income tax for the state in which services are performed (the work state).” When employees work in different states than where your company is located, your business will have to manage multi-state payroll tax compliance. The most common reasons multi-state payroll taxes situations occur when:

- You operate multiple business locations in different states.

- Your business is located near the border between two or more states, so employees commute in from other states.

- You have employees working from home in other towns, counties or states.

- You have employees who travel to nonresident states for temporary work assignments or who work while also on personal travel.

In this article, we provide twelve best practices to help businesses manage the complexity of multi-state payroll taxes. We’ll also explain the benefits of having payroll tax management software or services to reduce compliance risk and allow you to focus on growing your business.

1. Correctly Identify Where Your Employees Work

Most of your company’s employees probably live in the same state your business is located in. That’s the least complex situation from a payroll and tax perspective. However, some types of employees work in several states, including truck drivers, healthcare workers, sales professionals, and work from home employees. This is where payroll taxes become more complicated. As we discussed in last week’s post, remote workers have the potential to expand your company’s tax nexus into the tax jurisdictions where they work in home offices. It is essential to keep information current about where remote employees live and work.

2. Develop and Upkeep a List of Taxing Agencies

Once you have determined where each of your employees live and work, you will need to make a comprehensive list of the taxing agencies in each state, county or municipality. This will help you know where to find forms and deadlines, where to make deposits, and how to check in about changes to regulations.

3. Familiarize Yourself with State Tax Laws and Requirements

In general, employers need to withhold income tax and make timely filings in the tax jurisdictions (state, county, locality) in which their employees work. However, the rules and requirements vary from state to state. Employers need to learn the payroll tax requirements for each state applicable to their workforce.

There are currently nine states that do not levy individual state income taxes or tax only certain types of investment income; therefore, they do not require employer withholding. These states are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Twenty-four states require employer withholding on the first day an employee works within the state. Others allow a grace period during which a non-resident employee could work within the state, without requiring employer registration or withholding. See this map for a visualization of least-friendly states to mobile workers and their employers. Proposed legislation from the Mobile Workforce Coalition would establish a 30-day threshold (per calendar year) across all states to provide uniformity for mobile workers.

4. Learn the “Convenience of the Employer Rule”

By applying the Convenience of the Employer Rule, there are five states (Arkansas, Delaware, Nebraska, New York, and Pennsylvania) that may tax income even when an employee neither lives nor works within the same state as the employer. If the employer requires the employee to work in another state (for the employer’s convenience) withholding is taken where work is performed. But if it is the employee who chooses to work in another location (for the employee’s convenience), as in the case of most remote workers, withholding must be made in both states.

5. Research Tax Requirements at the County and Locality Level

Not all states have municipality or county level payroll tax requirements, but about one-third of states have tax codes that do allow for it. Some states, including California, Delaware, Colorado and Alabama have only a handful of taxing jurisdictions, usually the larger cities. In addition, states such as Maryland, only empower counties to levy income tax. Yet other states, including Iowa, Kansas, Kentucky, Indiana and Ohio have hundreds of different taxing jurisdictions including town, city, county and school district level income taxation.

6. Create and Update a Master Schedule

To make sure you file all tax forms and make all payroll tax deposits on time, you will want to create a remittance and filing schedule for all the taxing jurisdictions applicable to your employees. This schedule will account for whether filings must be monthly, quarterly or annually in each applicable state, county and locality. You will need to regularly update this schedule to account for any employee location moves or changes to remittance and filing requirements.

7. Keep Up with Constant Regulatory Change

There are more than 11,000 taxing jurisdictions in the United States—each with its own tax code. Changes to their rules and schedules for tax filings and deposits happen all the time. Tax forms change. State legislatures revise wage and hour laws or withholding rates. To manage multi-state payroll taxes successfully, you will need to continually research changes and keep up to date in training on payroll issues and new regulations.

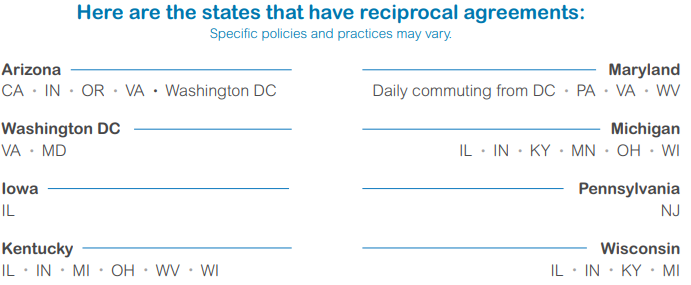

8. Understand Reciprocal Agreements Between States

Some states have reciprocal agreements with one another to ensure employees who live and work in different states are not subjected to double tax withholding. Payroll professionals need to keep track of reciprocity agreements in order to know where taxes are due and avoid making overpayments.

Sourced from Asure whitepaper, “Your Guide for Taking the Worry Out of Multistate Payroll Tax Management”

9. Do Not Try to Track Payroll Taxes Manually

Trying to track your payroll taxes for multiple states manually can result in costly errors. For most businesses, labor costs are the largest business expense. Mistakes in payroll calculations can create serious wage and hour compliance headaches and lower employee satisfaction. Further, any mistakes in your calculation, filing or deposit of payroll taxes can lead to penalties. Lower your risk and play it safe by using payroll and tax software or services.

10. Do Not Keep Tax Funds in Your General Account

When taxes are due, you must be certain you have the money needed to pay them on time. Estimate your payroll tax liability and keep those tax funds separate from your main account.

11. Reconcile Payroll Accounts Daily

By reconciling daily, you can identify problems immediately. The penalties associated with payroll errors can grow quickly, so it is important not to let problems compound.

12. Bring on Professionals with Multi-State Tax Expertise

Whether you use a third-party tax service or do it in-house, be sure that you’ve got the skills you need to keep up with your multistate tax obligations. If you choose to hire someone in-house, find someone with multi-state experience and provide additional training to keep them up to date. Offer incentives for workers who earn Certified Payroll Professional certificates and have employees repeat refresher courses annually. Bigger companies often provide industry-leading training so you can benefit from hiring from large providers because your employees will already have extensive training.

Ensure Compliance with Complex Multi-State Payroll Taxes

Businesses with multi-state payroll tax obligations will benefit from using fully automated payroll tax software or services backed by a team with deep multi-state expertise. Payroll Partner’s payroll tax management software and service tracks pay and file requirements, including deposit and filing schedules, for all 11,000+ tax codes in the U.S.

Payroll Partners can help your business streamline payroll tax processing and avoid risks with multiple options from complete full-service processing to software that guides your in-house management of multi-state taxes. Get more tips about how to ensure compliance with multi-state payroll tax rules by watching this on-demand webinar, “Multistate Payroll Tax: Compliance with a Remote Workforce.”