Texas Independent Contractors

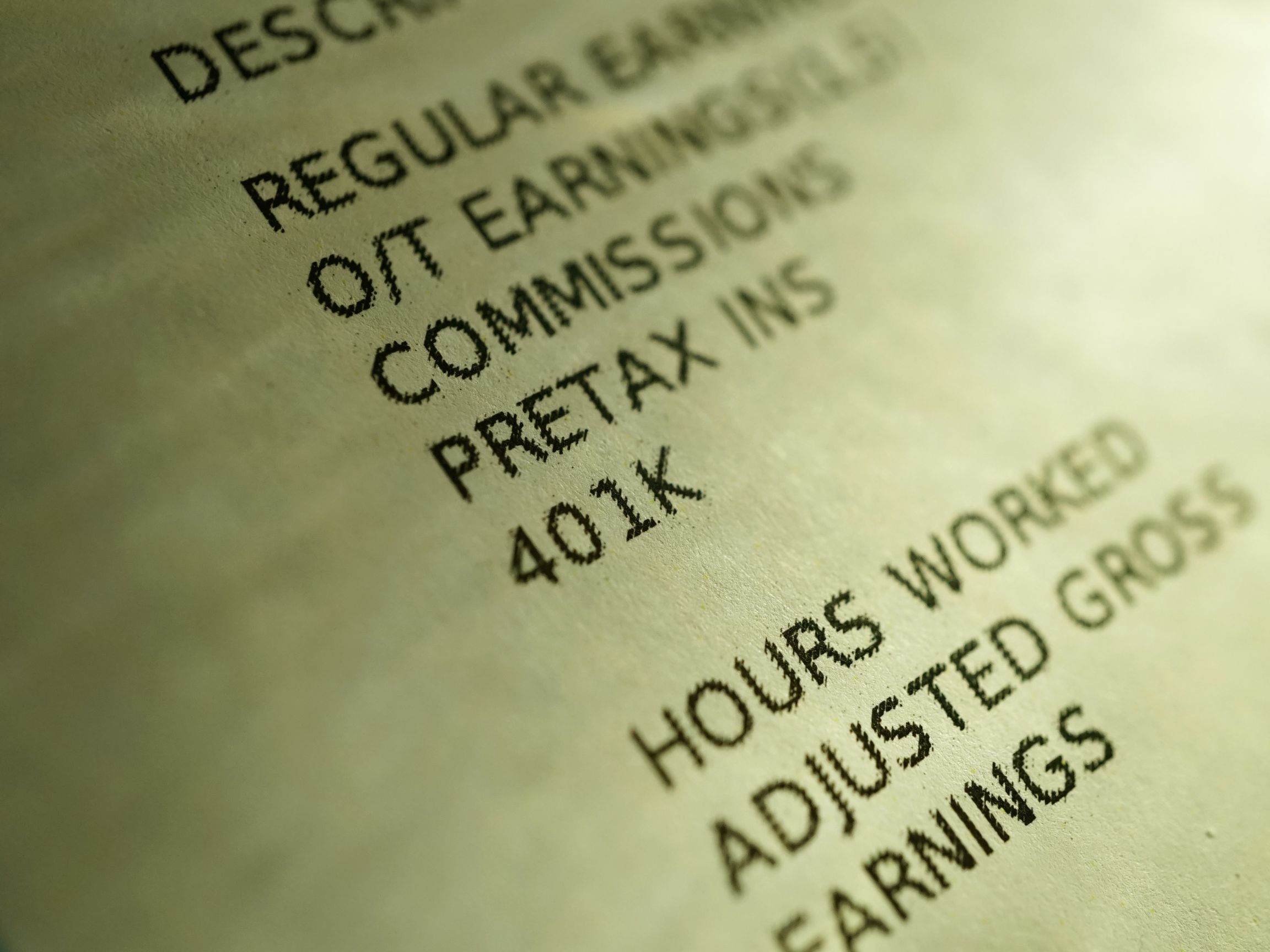

Employers are generally required to withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. Alternatively, employers are not generally required to withhold or pay any taxes on payments to independent contractors. Moreover, according...