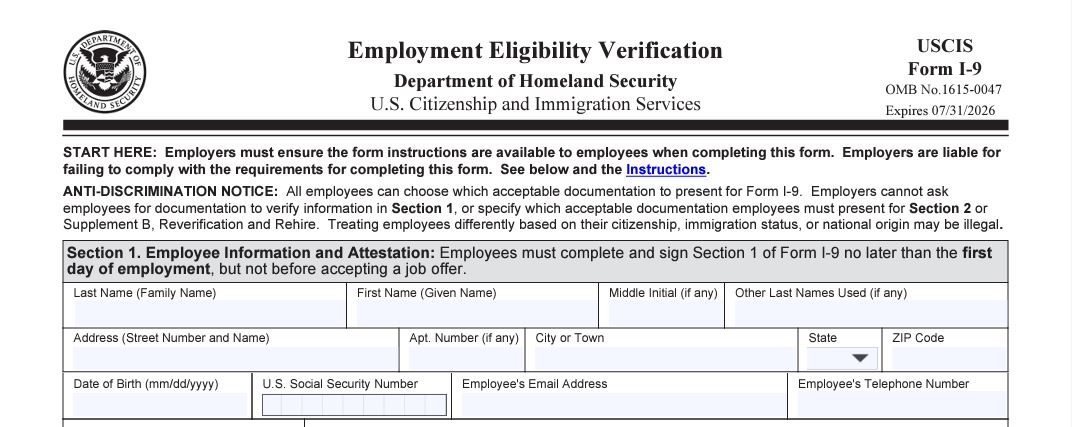

Can we dock an employee’s PTO for taking a long lunch?

Question: We have an exempt employee who has been taking a lot of long lunches and my boss wants to deduct time from her paid time off (PTO) bank. Can we dock her PTO for taking a long lunch? Answer: You can deduct hours from this exempt...